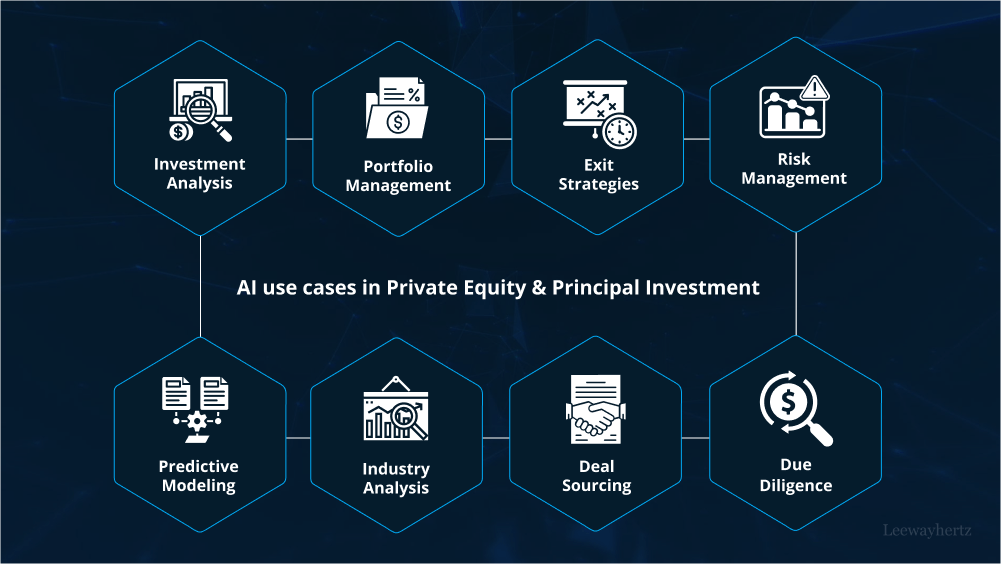

Artificial Intelligence (AI) has emerged as a transformative force across various industries, and private equity and principal investment are no exceptions. In recent years, AI technologies have been increasingly adopted in the financial sector, offering significant advantages in decision-making, risk assessment, and operational efficiency. This article explores some of the key AI use cases and applications in the world of private equity and principal investment.

- Data-driven investment decisions: AI excels in analyzing vast amounts of data, and this capability is highly valuable in making data-driven investment decisions. Machine learning algorithms can sift through historical financial data, market trends, and company performance to identify potential investment opportunities and predict their potential returns.

- Predictive analytics: AI empowers private equity firms to harness predictive analytics, enabling them to foresee market trends and make more informed investment choices. Predictive models can help identify undervalued assets and potential acquisition targets, reducing investment risks and enhancing overall portfolio performance.

- Automated due diligence: Conducting due diligence is a critical process in private equity and principal investment. AI streamlines this procedure by automating data collection, analysis, and risk assessment. Natural language processing (NLP) algorithms can scour vast legal documents and contracts, ensuring that potential legal and financial risks are identified.

- Risk assessment and management: AI-driven risk assessment tools provide invaluable insights into investment risks. Machine learning algorithms can analyze various risk factors, such as financial performance, market volatility, and geopolitical events, to offer a comprehensive risk profile for a particular investment.

- Portfolio optimization: Building and managing a diverse and robust investment portfolio is a complex task. AI-powered portfolio optimization tools take into account various parameters, such as risk tolerance, expected returns, and market conditions, to construct optimal portfolios that align with investors’ objectives.

- Sentiment analysis: Sentiment analysis, another application of AI, involves analyzing social media, news, and other online sources to gauge public sentiment toward companies or industries. This information can provide early signals of potential investment opportunities or risks, allowing investors to adjust their strategies accordingly.

- Algorithmic trading: Algorithmic trading, or quant trading, utilizes AI algorithms to execute trades at high speeds and frequencies, exploiting market inefficiencies and generating better returns. This approach is particularly popular among hedge funds and large financial institutions.

- Alternative data analysis: AI can process and interpret unconventional data sources, such as satellite imagery, geolocation data, and sensor information, to gain unique insights into companies’ performance and industries’ trends. Incorporating alternative data into investment strategies can provide a competitive edge.

- Smart deal sourcing: AI can assist in identifying potential deal opportunities by scanning vast amounts of publicly available information and matching investment criteria. This allows private equity firms to stay ahead in a highly competitive market.

- Post-investment monitoring: After an investment is made, AI can continuously monitor the performance of the invested assets. This real-time monitoring helps identify any issues or deviations from expected outcomes, allowing investors to take timely corrective actions.

- Personalized investor communication: AI-powered tools can analyze individual investor preferences and behaviors, enabling personalized and targeted communication. This fosters stronger investor relationships and enhances investor satisfaction.

- Fraud detection and prevention: In the financial world, fraud is a persistent concern. AI can help identify unusual patterns and detect potential fraudulent activities, safeguarding investments and minimizing financial losses.

- Valuation modeling: AI can improve the accuracy of valuation models by incorporating a broader range of factors and historical data, reducing human biases and errors in the valuation process.

- Operational efficiency: Beyond investment-related tasks, AI can enhance operational efficiency in private equity and principal investment firms. From automating routine administrative tasks to streamlining back-office operations, AI can free up valuable human resources for more strategic activities.

In conclusion, AI has proven to be a game-changer for the private equity and principal investment industry. The adoption of AI-driven tools and technologies empowers firms to make more informed investment decisions, manage risks effectively, and optimize portfolio performance. As AI continues to evolve and become more sophisticated, its impact on the financial sector will undoubtedly grow, shaping the future of private equity and principal investment. However, it’s important to note that while AI brings many benefits, human expertise and judgment remain crucial in navigating the complexities of the financial markets and making successful investment choices.

To Learn More:- https://www.leewayhertz.com/ai-use-cases-in-private-equity-and-principal-investment/