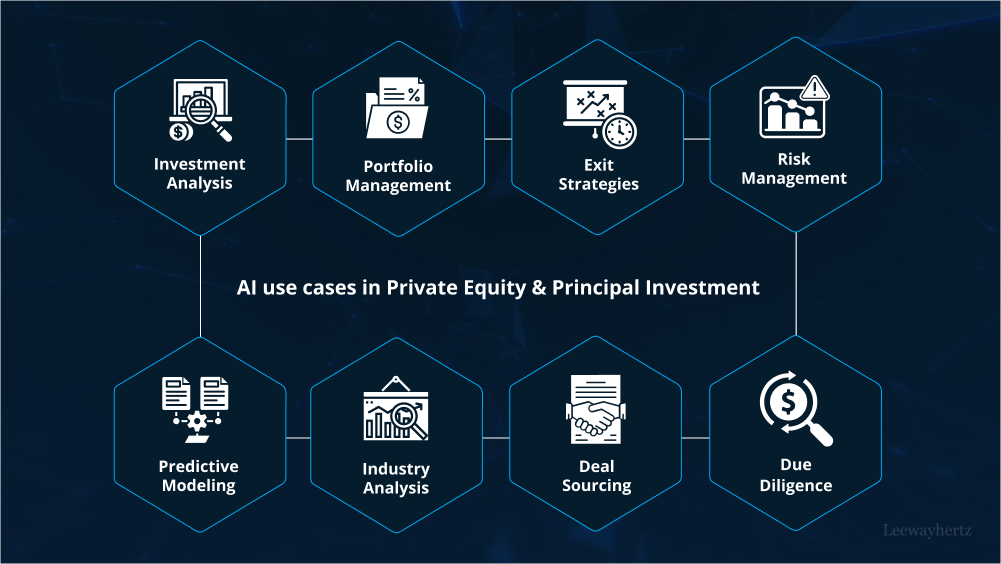

Artificial Intelligence (AI) has emerged as a transformative force across various industries, reshaping business operations and decision-making processes. In the realm of finance, particularly within private equity and principal investment, AI is revolutionizing how investment strategies are formulated, risks are managed, and opportunities are identified. This article explores the dynamic landscape of AI applications in private equity and principal investment, highlighting key use cases and their impact on the industry.

Enhancing Due Diligence

One of the fundamental aspects of private equity and principal investment is due diligence – the meticulous process of assessing the viability and potential risks of investment opportunities. AI-driven algorithms excel in sifting through massive amounts of data, analyzing financial statements, market trends, and industry benchmarks to provide a comprehensive understanding of potential investments. Machine learning models can swiftly identify patterns, anomalies, and red flags that might escape human scrutiny, thus aiding in making more informed investment decisions.

Predictive Analytics for Investment Performance

AI-powered predictive analytics has the potential to provide valuable insights into the future performance of investments. By analyzing historical data and market trends, AI algorithms can generate forecasts about the financial performance of companies or assets, enabling investors to anticipate potential returns and risks. These predictive models can assist in optimizing portfolio allocation and making strategic adjustments based on market dynamics.

Portfolio Management and Optimization

AI’s ability to process vast amounts of data in real time allows private equity firms and principal investors to effectively manage and optimize their portfolios. Advanced algorithms can continuously monitor market conditions, news sentiment, and company-specific events to provide up-to-date recommendations for portfolio rebalancing. This dynamic approach ensures that investment strategies remain aligned with shifting market trends and investor objectives.

Risk Assessment and Mitigation

AI-driven risk assessment tools play a crucial role in evaluating the potential risks associated with investment opportunities. Machine learning algorithms can identify hidden risks by analyzing historical data and recognizing patterns that may indicate financial distress or other adverse circumstances. This enables investors to make more informed decisions and implement risk mitigation strategies proactively.

Deal Sourcing and Opportunity Identification

AI-powered algorithms are transforming the way private equity firms and principal investors identify potential investment opportunities. Natural Language Processing (NLP) techniques can scan vast amounts of news articles, financial reports, and social media data to identify emerging trends and market inefficiencies. This not only expedites deal sourcing but also enables investors to stay ahead of the curve in identifying promising investment targets.

Operational Efficiency and Cost Reduction

Beyond investment decisions, AI offers opportunities for operational efficiency and cost reduction within private equity and principal investment firms. Automation of routine tasks such as data entry, reporting, and compliance can free up valuable human resources to focus on more strategic activities. Additionally, AI-powered chatbots and virtual assistants can enhance communication with clients and stakeholders, providing timely responses to inquiries and streamlining customer interactions.

Challenges and Considerations

While the potential of AI in private equity and principal investment is immense, there are challenges that require careful consideration. The quality and accuracy of data fed into AI models are critical, as erroneous or biased data can lead to flawed insights and decisions. Moreover, the integration of AI technologies into existing workflows and the need for specialized expertise may pose implementation challenges.

Conclusion

AI is reshaping the landscape of private equity and principal investment, enabling firms to make more informed decisions, optimize portfolios, and identify lucrative opportunities. The ability of AI to process vast amounts of data, predict future trends, and enhance operational efficiency positions it as a transformative tool for the industry. As technology continues to advance, private equity and principal investment professionals should embrace AI’s potential while being mindful of the challenges and considerations that come with its implementation. The synergy between human expertise and AI-driven insights will likely define the success of future investment strategies in an ever-evolving financial landscape.